Loss of Customer Trust: The Hidden Cost of

Cybersecurity Breaches in SMBs

Customer trust is an invaluable asset

for any business – especially for small and medium-sized enterprises (SMBs)

whose customers rely on them for personal service and reliability. When a

cybersecurity incident occurs, that trust can evaporate almost overnight. In

fact, studies show that cyber breaches overwhelmingly damage reputation and

customer confidence. For example, KPMG found that 89% of small businesses who

suffered a data breach reported a negative impact on their reputation. When

customers feel their personal data is unsafe, they experience anxiety, anger

and a sense of betrayal – an emotional toll that can linger long after a breach

is fixed.

Not only do breaches upset customers

emotionally, they also damage a company’s brand and bottom line. High-profile

incidents (see case studies below) show how a single lapse – often human error

– can lead to regulatory fines, lost sales and plummeting stock prices.

Financial costs (fines, remediation, lost revenue) and reputational costs (bad

press, customer churn) compound the damage. An IBM report notes that the global

average cost of a data breach hit \$4.88 million in 2024, the highest ever.

Worse, the cost of lost customer trust can exceed the breach cost: JumpCloud

reports that training programs can yield “50× return” on investment because

educating staff is “one of the best security investments” – implying breaches

(the inverse of training) can be hugely costly.

In short, when SMBs fail to protect

data, they risk losing the faith of their customers, which can have three major

consequences:

·

Emotional

Impact: Customers may feel violated, anxious or angry when they learn their

data (names, contact details, payment info, etc.) was exposed. This damages the

customer-company relationship. Trust – once lost – is hard to rebuild. As one

security expert warns, “the only way forward…is clear and concise

communication… to rebuild consumer trust” after an attack. Poor handling (slow notification, denial) only

deepens customers’ sense of betrayal.

·

Reputational

Damage: News of a breach spreads quickly online. A tarnished reputation can

scare away not only customers but also partners, investors, and job candidates.

For example, in 2018 British Airways admitted hackers had stolen data on

~420,000 customers; the incident “drew heavy criticism” and led to a record £20 million

ICO fine. Even after technical fixes, airlines like

Qantas found it a “setback” for an airline “rebuilding trust”. Studies show that nearly 3 in 10 breached small

companies permanently lose customers due to mistrust. In short, one breach can undo years of

brand-building.

·

Financial

Loss: Beyond fines and penalties, loss of trust directly hits revenue.

Customers may abandon online services or switch suppliers. In severe cases firms

go out of business: one study claimed “60% of small businesses shut down

within 6 months after an attack” (though this stat is contested, it

underscores the risk). Even without collapse, recovering trust costs money –

via marketing, customer compensation, and increased security spending.

JumpCloud notes that “customers away” and damaged brand value are key financial

drivers behind cybersecurity ROI.

The table below summarizes some

high-impact breaches and their trust consequences:

British

Airways boarding pass, illustrating the type of customer travel data exposed in

its 2018 breach.

The dynamics above show how trust

erodes when breaches occur. Crucially, many breaches are preventable.

Research consistently highlights human error as a root cause – for instance,

Mimecast found that 95% of breaches involve some form of human mistake

(clicking a link, misconfiguration, stolen credentials). Inadequate staff training and security

awareness mean malicious emails (phishing), weak passwords and careless sharing

become fatal vulnerabilities. Indeed, a Qualys report notes “less than 25%

of small businesses conduct regular cybersecurity training… [yet] human error

remains the leading cause of breaches”. In other words, when staff aren’t trained to

recognize threats or follow protocols, the risk of a breach – and the resulting

loss of customer trust – skyrockets.

Recovery from such a loss is tough.

Experts agree that only transparency and action can begin to rebuild faith.

After TalkTalk’s fiasco, consultants said the company “must rebuild consumer

trust… with a plan to rectify the issue”. Qantas’s CEO reiterated that “customers

trust us with their personal information and we take that responsibility

seriously.” She pledged full cooperation with authorities and promised

improvements. Firms often need to offer free credit

monitoring, public apologies, and visible security overhauls. The key point for

SMBs is that waiting to be breached is far costlier than investing in prevention

and communication plans ahead of time.

Key takeaways for SMBs: Prioritize a

culture of security. Treat customer data as sacrosanct. Ensure staff training

on phishing, strong passwords, and data handling – it’s often the weakest link

in the trust chain. Implement technical safeguards (encryption, multifactor

auth) to reduce breaches. And have an incident response plan ready: fast,

honest communication after an incident can salvage trust. In fact, Pyralink’s

own experts emphasise that “only by having an effective post-breach response

plan can consumers regain trust in the brand”. SMB leaders should thus embed security into

company values and demonstrate it openly to customers.

By addressing both technical and human

factors, and by owning mistakes transparently, SMBs can protect and restore

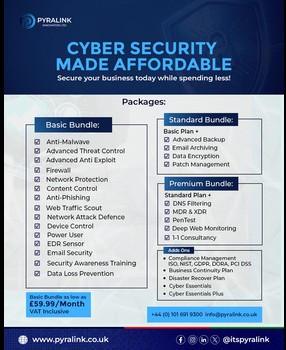

customer trust. Pyralink’s services (from vulnerability audits to awareness

training) are designed precisely to help UK SMBs do this. For example,

Pyralink’s Security Awareness Training can empower employees to spot phishing

and use best practices, closing the human gap that often leads to breaches.

Coupled with Pyralink’s managed IT security and compliance services, an SMB can

present a robust defence – assuring customers that the business takes data

protection seriously and can be trusted with their information.

FAQ – Loss of Customer Trust

·

How

long does it take to rebuild trust after a breach? There’s no simple answer, but rebuilding trust

often takes years. JumpCloud notes that “losing trust can take years (and

major marketing dollars) to rebuild”. Clear, ongoing communication and demonstrable

improvements in security are critical steps.

·

Can

small businesses recover from losing customer trust? Yes, but it requires effort. SMBs can recover by

publicly acknowledging issues, fixing vulnerabilities, and maybe offering

remediation (e.g. identity protection services). Being proactive (e.g. showing

cybersecurity certifications) helps reassure customers.

·

Is

customer trust more at risk now? Customers today are more aware of data issues. High-profile

breaches have made many people cautious. SMBs can turn this into an advantage

by making security a visible priority and differentiator.

·

What

role do employees play in customer trust? A big one. Employees handle customer data daily.

If they’re not security-conscious, breaches happen and trust is lost. Regular

training and a security-minded culture ensure every staff member helps protect

trust.

·

How

does compliance affect trust? Being compliant with standards (like

GDPR or Cyber Essentials in the UK) shows customers you meet recognised

security benchmarks. This can bolster confidence. Conversely, non-compliance

exposes you to risks that can ruin trust.