Cyber-Attacks in the Financial Sector: A Rising Threat to Global Stability

Cyber-attacks have skyrocketed in sophistication and frequency, posing unprecedented threats to the financial sector's stability. As financial institutions become increasingly digital, they attract a breed of cyber criminals whose methods are as diverse as they are dangerous. This escalating threat directly challenges global financial stability, necessitating immediate attention and robust countermeasures.

The Current Landscape of Cyber Threats in the Financial Sector

Statistics on Cyber Attacks

The frequency of cyber attacks in the financial sector has surged dramatically. Recent reports indicate that these attacks are becoming more frequent and complex, representing a significant danger. For instance, the International Monetary Fund highlighted the increasing risks in their Global Financial Stability Report. The relentless rise in cyber events has left financial institutions scrambling to adapt and safeguard their assets.

Common Types of Cyber Attacks

Financial institutions are frequent targets of diverse cyber threats, including phishing, ransomware, and data breaches. Phishing and ransomware remain particularly prevalent, often leaving companies with significant financial and reputational damage. Other threats, like SQL injections and insider threats, also contribute to the growing concern within the sector.

Impact of Cyber Attacks on Financial Stability

Financial Losses and Recovery Costs

Cyber attacks impose heavy financial burdens on institutions, encompassing both direct losses and extensive recovery costs. The ABA Banking Journal reports that the average cost of ransomware attacks reached over $5 million, significantly impacting an institution's bottom line.

Loss of Consumer Trust

Beyond financial losses, cyber breaches erode consumer trust—a critical component for any financial institution's long-term success. Once trust is compromised, regaining it becomes an arduous task, affecting customer retention and acquisition for years to come.

Regulatory Responses and Compliance Challenges

As cyber threats grow, so does the complexity of regulatory landscapes. Compliance remains a significant challenge for institutions striving to meet ever-evolving regulatory requirements designed to protect consumer data and maintain system integrity.

Case Studies of Notable Cyber Attacks

The Equifax Breach

The 2017 Equifax breach remains one of the most significant cybersecurity failures in history, exposing the personal information of over 147 million individuals. This incident not only disrupted consumer trust but also led to massive financial repercussions for Equifax and prompted renewed attention to cyber resilience.

Targeted Attacks on Banks

Major banks have also fallen victim to complex cyber-attacks. These events have exposed vulnerabilities within the banking system, prompting institutions to bolster their defenses and adopt more sophisticated security measures.

Strategies for Enhancing Cybersecurity in Financial Institutions

Investment in Cybersecurity Technologies

Investing in advanced technologies such as artificial intelligence and machine learning can fortify defenses against cyber threats. These tools offer vital capabilities in predicting, detecting, and responding to cyber incidents efficiently and effectively.

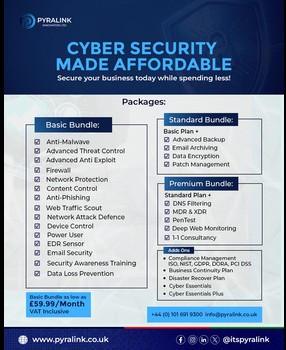

Employee Training and Cyber Hygiene

Pyralink provide on-demand expert-led sectrainings on cybersecurity for teams. We understand that a well-trained workforce is the first line of defense against cyber threats. Emphasizing cyber hygiene and equipping employees with the knowledge to recognize and thwart cyber threats can prevent many potential breaches.

Collaboration with Government and Agencies

Collaboration with government entities and cybersecurity agencies is essential for sharing intelligence and improving collective defense mechanisms. Organizations like FS-ISAC are at the forefront of this cooperative effort, promoting resilience in the financial sector.

Conclusion

With cyber threats mounting against the financial sector, the imperative for sturdy cybersecurity measures has never been clearer. Protecting against these risks is crucial not just for individual institutions but also for the broader stability of the global financial system. Robust security technologies, continuous workforce education, and strategic collaborations are keys to navigating this perilous landscape. As threats evolve, so too must our defenses. The cost of inaction is far greater than the investment required to secure our financial future.